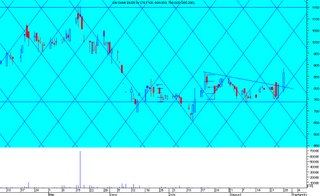

nothing in the universe is random they follow matths (maths came from matho which means life) nothing is exempt from the laws every thing is a cause and effect. including markets. see how bank of baroda is tracing atomic number. behind the wall god is working with numbers. everyrhing is a sequce seqeuce to the sequnce. important thing is thing time calculatins.

yours humbly